Deep Dive Research: Video Surveillance Shifts From Pause to Play

Slowed by the effects of the pandemic and supply chain morass, this sector is looking to push the fast-forward button. SSI’s Video Surveillance Deep Dive freeze-frames installations, prices, profits, verticals, challenges and technologies.

Conducted during April 2023, the fifth installment of SSI’s Video Deep Dive survey again included dealers and integrators from throughout the United States and Canada.

For many years now, video surveillance has ruled the electronic security roost where it comes to opportunities for providers of professionally installed systems to grow their businesses and for their end-user customers to realize much higher value for their dollar.

The trend paid off exponential dividends as the parade of enhancements and advancements to cameras, recorders, compression and imaging software, and network infrastructure proceeded at a seemingly boundless clip. Then just as it seemed the raging torrent might be tapering off, a multitude of innovations — such as analytics or the Cloud — that further augment or are built on video’s foundation have flooded the market. The most recent one, which promises myriad permutations and incalculable possibilities, is artificial intelligence (AI).

The ongoing vitality of video has played a key role upholding the security industry’s longstanding reputation for being recession-resistant and notoriously resilient, even in the face of and wake of potentially crippling events like the pandemic, inflation, supply chain, labor shortage and crises abroad. Further entrenching video surveillance into the basic fabric of commercial enterprises has been its expanded integration capabilities with other security and building systems, extending functionality to operations and productivity. Similarly on the residential side, hastened by the ubiquity of doorbell, poolside and perimeter cameras, video has become equally pervasive in the home.

Against that dynamic backdrop, witness how those chief factors and catalysts are at play affecting the results and conclusions of Security Sales & Integration’s 2023 Video Surveillance Deep Dive research project. Conducted during April 2023, the fifth installment of SSI’s Video Deep Dive survey again included dealers and integrators from throughout the United States and Canada. In addition to the sprawling territorial footprint, the study pulled more than 100 respondents from an expansive span of company sizes with various years in business. The questions ran the gamut of residential, commercial and industrial sectors — including projects, prices, margins, verticals, challenges, technologies and more.

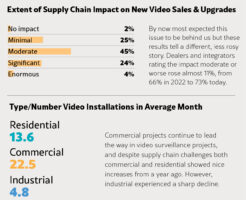

According to the survey’s results — despite acknowledgement of the supply chain’s snarl of components and logistics complications — by and large security contractors indicate they find themselves toiling in a landscape more closely resembling prepandemic projects, profits and possibilities. For instance, aside from a dip in the number of industrial jobs, installation volume, sales prices and gross profit margins are up across the board. This positive perspective is further heightened by looking at the healthy upticks in both video surveillance business during the past year and, as a consequence, the past five years.

Less encouraging is the ongoing commoditization of cameras, as evidenced via more units per installation but at lower prices. The top three markets are commercial offices, government and single-family homes. Megapixel cameras, IP-based LAN systems and remote access capabilities are the most pervasive video technologies. Helping immensely on the recurring revenue front, video surveillance as a service (VSaaS) is more rapidly being adopted, even as dealers and integrators note more conflicts dealing with customers’ IT departments and network challenges.

From a 30,000-foot view, end users are being won over by ever-more advanced, appealing and affordable technology and products, along with an almost infinite array of capabilities and use cases that bridge security and organizational efficiencies. On top of that, security dealers and integrators are tapping into new video-based RMR streams and, as the supply chain unfurls, manufacturers figure to ramp up their R&D and introductions of more innovative solutions. This portends that video surveillance will remain a massive market for the foreseeable future. Descending down from that high altitude, take a Deep Dive into the latest key datapoints.

View the 2023 Video Surveillance Deep Dive

Click here to download the Deep Dive as a PDF

Sponsored by

![]()

![]()

If you enjoyed this article and want to receive more valuable industry content like this, click here to sign up for our FREE digital newsletters!

Security Is Our Business, Too

For professionals who recommend, buy and install all types of electronic security equipment, a free subscription to Commercial Integrator + Security Sales & Integration is like having a consultant on call. You’ll find an ideal balance of technology and business coverage, with installation tips and techniques for products and updates on how to add to your bottom line.

A FREE subscription to the top resource for security and integration industry will prove to be invaluable.