2022 Home Automation Deep Dive: Resi Dealers Thrive Despite Turbulent Times

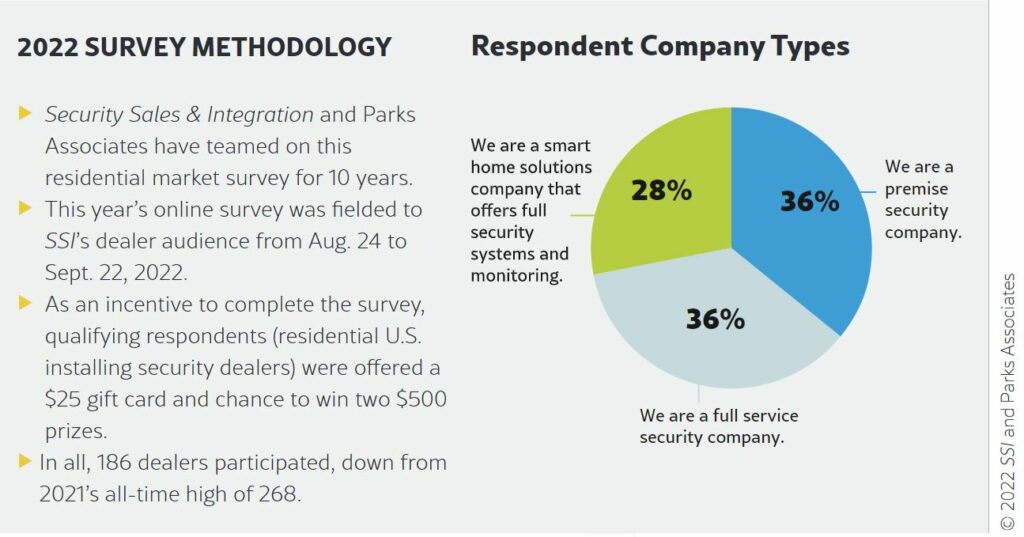

Developed in partnership with Parks Associates, the 2022 Home Automation Deep Dive examines how security dealers are handling the real estate boom, the fallout of COVID and the impact of DIY security systems.

Security dealers have been steady through booms and some difficult times. Security Sales & Integration and Parks Associates are in their 10th year of partnering to survey residential security dealers. What a ride it has been — from the end of the financial crisis recession, to boom years, and now a mixed and turbulent environment.

Fortunately, the 2022 Home Automation Deep Dive, fielded late this past summer, once again demonstrates the incredible resiliency and ongoing vibrancy of the electronic security and smart home industry.

Highlights of the analysis, graphs and data ahead includes:

- Significant progress in realizing the benefits of smart devices integrated with security systems continues.

- Matter, a standards effort to guarantee interoperability, has finally been completed and will be a big step forward when widely adopted.

- The remainder of 2022 and 2023 promises to be stormy.

- Economists themselves argue about how serious a recession is occurring — or even if a recession is occurring.

- Security dealers need to be careful of their costs but also seize the opportunities that remain strong.

Success Path Riddled With Potholes

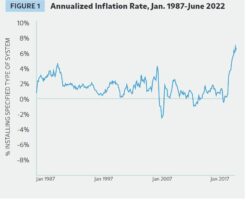

The markets have received multiple gut punches since mid-2021. Inflation has reared its ugly head and is damaging consumer confidence as well as household budgets and multiple marketplaces. Figure 1 displays inflation from 1987 to June 22, 2022. What screams out is the high inflationary period the nation is enduring today.

That, in turn, alarms the Federal Reserve so it is raising prime rates to tame the inflation beast. The last week of September, the Fed raised prime rates ¾ of a point. More increases are in the offing. As a result of rising rates, mortgage rates have increased. Today, they are at or near 7%. And the effects keep rolling.

Inflation amplified by supply chain disruptions means builders must pay more for many materials. Prices then rise. Higher mortgage rates reduce the amount of mortgage for which a household qualifies as well as increases potential monthly payments. New starts, a bulwark for installed security systems, have declined 10% since February 2021.

The same conditions lead to lower sales of existing homes as households decide to stay where they are if they can. Housing prices have fallen as buyers see that homes are not selling overnight. The last great months were January/February 2022 as buyers rushed to buy and sellers rushed to sell before rates increased significantly. On top of all this, the stock market fell into bear territory in 2Q 2022 and will be rocky for the near to mid-term future. That shakes confidence for even upscale households.

Safety Sought Amid Rising Crime

Throughout it all, most security dealers have adapted well. Driving sales for security systems are increased crime rates, new DIY systems that cost less than traditional professionally monitored security, and smart home products with declining prices and benefits of convenience, safety, and security.

Crime has risen 4% in 2022 thus far but delving into stats shows a troubling story. Robbery is up 12% and aggravated assault 3%. In viewing stats in the rearview mirror, since 2019, there has been a 50% rise in homicides and a 36% rise in aggravated assaults. Our news channels cover this all the time along with detailing the continuing shortage of police officers. Americans are anxious about their safety, their security and their budgets. It is also election time and polarization remains rampantly divisive.

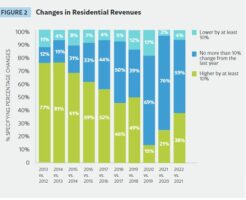

Carrying on through all of this is the security industry. SSI and Parks Associates’ survey respondents must offer installation of systems. They can also sell DIY systems. None of them have a retail location. Figure 2 shows revenue reporting from 2012 to 2022. To a great extent, revenue follows environmental and market conditions.

For example, 2013 and 2014 were robust recovery years following difficult years that resulted from the financial crisis of 2008. More recently, dealers report high percentages of stable revenues. Nearly 20% of dealers reported lower revenues in 2020 vs. 2019. This was early pandemic and households were anxious about contracting COVID and did not want technicians in their homes. For 2022, nearly 35% of dealers expect higher revenues than in 2021. This shows a steadiness in which the security industry can take pride.

Most Powerful Drivers

As dealers realize that customers want smart home devices with their security systems, more adopt those products in their portfolios (Figure 3). Between 2021 and 2022, the percentage of dealers offering interactivity and smart home products increased by nearly 15%. Conversely, the percentage of dealers selling only traditional systems without interactivity declined by 70%, from 33% to 24%. Some of these changes may be the result of a different mix of responding dealers. However, the trend is apparent.

Customers’ desire for smart home devices with their security systems has ranked as the top business driver for two years running (Figure 4). That is both a warning and an opportunity for dealers. Security dealers represent the optimum channel for complex smart homes; that is homes with a security system and multiple diverse ancillary additions. To not offer those devices will quickly force a dealer into being a ‘value’ outfit. If this is a strategy, fine; but if not, dealers must address the needs of their locale and offer smart product solutions.

For example, Texas and Arizona need sprinkler systems and pool controls, the smarter the better. Vermont needs freeze warnings and the like. Next, fear of crime with its accompanying sense of helplessness is the second-most important driver for security. The next three important drivers all relate to housing — buying and selling. Housing opportunities will be lower in volume than in the past few years.

Most Damaging Inhibitors to Sales

Topping the list of residential security solutions sales inhibitors is the inability to find needed employees (Figure 5). One of the outcomes of the pandemic is a changed labor force. Many people want to stay remote workers for at least part of their workweek. Others want total remote working conditions. Further, unemployment remains low, a bit of a mystery in the weak economic environment.

Workers have had the luxury of being demanding and job jumping. Recession may change that, but in the meantime, companies must pay more for employees who may or may not have the skills needed. Leftover challenges from the pandemic include continuing supply side disruption; that has been the second-highest business inhibitor for two years.

Interestingly, this year’s respondents are only half as likely to cite DIY systems as important competition as last year. Part of that is the sense that the worst of COVID is past, and people are returning to normal habits, which include technicians in the home. Jumping higher on this year’s list of inhibitors is constrained consumer spending; that will continue for at least the next year.

Home Devices Getting Smarter

The 2022 Home Automation Deep Dive queried dealers selling smart home products about the difficulty of integrating devices with their security systems. As the data in Figure 6 shows, things improved greatly in 2022 over 2021. In part, this may be because the survey’s list of smart home devices included fewer items, reduced from 15 to nine from the prior survey.

Still, the trend emerges; manufacturers continue to work at simplifying integration as they understand that integration increases their products’ benefits, and that complexity inhibits dealers from adopting a product brand or category.

Compatibility among products, the ability for products to interoperate, is critical to realizing the full benefits of these devices. Interoperability also provides an opportunity for evermore differentiation to dealers and manufacturers. To tackle compatibility issues, Amazon, Apple, Google, Samsung and other companies came together through the Connectivity Standards Alliance (CSA), an IoT-focused organization, to create a new connectivity standard for smart home devices.

This standards effort to provide interoperability among devices, dubbed Matter, has finally just been approved. If it is successful, always a challenge for standards, it promises to be a major step forward to actualizing the “smart house.” Today, there is no single answer to, “What is a smart home?” There are smart devices, smart subsystems, and integration across these categories. However, the degree of smartness and integration varies.

Security dealers are just now becoming aware of Matter. During the past two years, only between 20% and 40% of responding dealers reported any familiarity with the effort. This is an important initiative for dealers to track.

Tricia Parks is Owner and CEO of Dallas-based Parks Associates.

If you enjoyed this article and want to receive more valuable industry content like this, click here to sign up for our FREE digital newsletters!

Security Is Our Business, Too

For professionals who recommend, buy and install all types of electronic security equipment, a free subscription to Commercial Integrator + Security Sales & Integration is like having a consultant on call. You’ll find an ideal balance of technology and business coverage, with installation tips and techniques for products and updates on how to add to your bottom line.

A FREE subscription to the top resource for security and integration industry will prove to be invaluable.