Home Automation Deep Dive 2023: Security Dealers Facing Staffing, Economic Challenges

Annual SSI and Parks Associates report shows talent shortage leads the way among obstacles facing residential security integrators.

Adobe Stock image by Pixel-Shot

In 2023, dealers have faced a rocky road. High interest rates and lower home sales have meant fewer consumers are moving, making this a critical time for acquiring a new security system or getting monitoring services. Inflation continues to temper consumer spending, while DIY products compete with security systems for consumers’ dollars.

Dealers are branching out into new areas to bolster revenues and to find applications that require or value professional installation and monitoring. This includes home-network monitoring, vehicle monitoring, and new partnerships with insurance companies.

In this 11th annual survey, conducted jointly by SSI and Parks Associates, we investigate how dealers see the market today, while also analyzing the strategies that show opportunity for growth.

Our survey, Security Dealer Perspectives: Views from the Front Line, was fielded between Aug. 30 and Sept. 22, 2023. A total of 130 dealers responded to the survey.

For all completed surveys, SSI and Parks Associates provided a $25 thank you. In addition, two dealers who completed the survey were randomly selected to receive one of two $500 prizes.

The entire respondent pool was composed of residential security dealers in the U.S. or Canada, although many also conduct commercial business.

This year’s study sought to assess the most important business drivers for dealers’ residential business and the challenges that dealers face today. It quantifies shifting demand for smart-home devices during the initial sale and as an aftermarket upgrade.

Moreover, it highlights dealer perspectives on how artificial intelligence (AI) and the Matter standard will affect their businesses.

Dealers Struggle with Staffing

Security dealers are noticeably less enthusiastic about their growth prospects in 2023. Nearly two-thirds of dealers expect to end the year about the same as last year, judging in terms of residential revenues.

Although few expect to see lower revenues, just one-third expect growth. Compare that with the incredible optimism for growth that we saw a decade ago, when 77% of all dealers expected to see year-over-year growth.

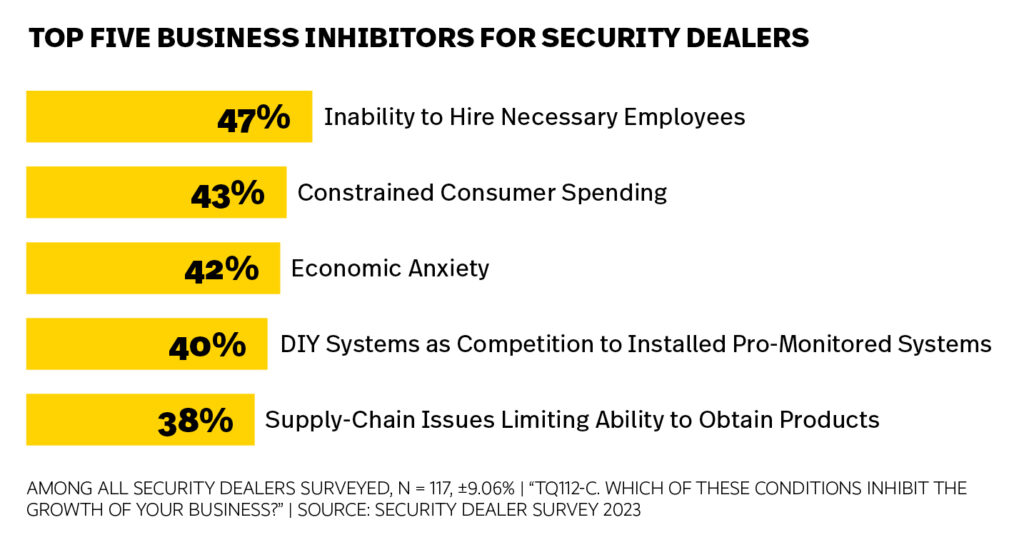

Macroeconomic factors are certainly an important headwind, as are staffing difficulties. Nearly half (47%) of dealers now report that they are unable to hire the necessary employees to support their business.

The most common approaches to overcoming staffing challenges include increasing salaries, offering on-the-job training programs and improving benefits.

As in other industries, employees are attracted by new work arrangements after many experienced the flexibility and reduced commutes afforded by remote work during the COVID-19 pandemic. To attract and retain staff, 35% of dealers are now offering flexible work arrangements.

Of course, competition from DIY systems remains a significant challenge for the industry, although dealers are finding ways to adapt to the threat. Although 40% of dealers count DIY systems as a barrier to growth, that percentage has decreased each of the past two years (down from 51% in 2021 and 45% in 2022).

In fact, 30% of dealers report that, now, they offer DIY security systems, with or without professional monitoring attached. Dealers hope that, by responding to clear market demand for these simpler solutions, they can onramp first-time buyers and upgrade them down the road.

And, indeed, Parks Associates’ consumer survey data finds that this does happen. To wit, 15% of households with a professionally monitored security system report switching from self-monitoring in the 12-month period prior to the survey.

Dealers Turn to Smart Home, Higher Monitoring Fees

Customers’ desire for smart-home devices with their security systems has ranked as the top business driver for three years running. In fact, about a third of dealers position themselves strategically as a smart-home solutions company, rather than positioning themselves as a premise security company.

We see this positioning from market leaders, including ADT, Vivint and Brinks. Both ADT and Vivint position smart-home devices prominently on their landing pages, and Brinks rebranded from Brinks Home Security to Brinks Home in 2021.

Smart video devices (e.g., network cameras, video doorbells) are dealers’ most commonly sold smart-home products, and the vast majority of those sales happen with the initial install. Currently, 20% of U.S. internet households report owning a video doorbell; meanwhile, 17% own a networked camera.

Manufacturers continue to bring new video-enabled devices to market, including flood lights, door locks, external keypads and garage-door openers with embedded cameras.

These devices are an important source of revenue not only because they drive up the overall price of the system but also because of the ongoing video access and storage fees that increase recurring monthly revenue (RMR).

In fact, dealers report that the average fee charged for professional security services is $54 per month, which represents strong growth since 2021, at which time dealers reported an average of $40 per month. Although this is an average across all types of systems and services, monthly fees vary widely.

For instance, dealers charge a customer who receives only professional monitoring with no interactive services $34 per month. That compares to an average of $67 per month for a system with professional monitoring, interactive services, smart-home devices, video storage and video verification.

The DIY market has proven the value that consumers place in video devices, such that video devices alone (meaning, not attached to a system) are “good enough” security solutions for many consumers. Dealers can benefit from this video-first thinking by embracing video-attached systems as a foundation of their packages.

In addition to video services, 75% of dealers offer value-added services, which build on their core capabilities, to drive new revenues. Home network services, whole-home technical support and PERS/medical-alert services are among the leading offerings.

Prominent brands ADT, Vivint and Brinks have struck deals to sell solar panels or partner with solar installers, as well.

We are still in the early stages of the energy and security markets coming together, and this remains uncommon today. Indeed, just 5% of dealers report installing solar panels.

However, 31% show interest in selling and supporting solar if a partner handles the installation. This points the way to new revenue potential in a market that will certainly require professional (not DIY) consultancy and support.

Matter and AI: What’s the Impact?

Matter, an IP-based application-layer communication standard maintained by the Connectivity Standards Alliance (CSA), is the smart-home industry’s latest attempt at simplifying development for smart-home product brands and manufacturers, while increasing the compatibility of the products for consumers.

Matter-supporting devices can communicate with each other locally, without pushing to the cloud, and the end user can select any Matter-enabled app or voice assistant to control any Matter-enabled device.

Just 24% of dealers are either familiar or very familiar with the standard, although it launched nearly two years ago, back in December 2019. Matter-enabled smart devices have been slow to come to market, but the standard has received widespread support from technology and security giants, including ADT, Amazon, Google and Apple, along with 600-plus other member companies.

Matter’s implications are a double-edged sword for security service providers. By lowering the barriers for smart-home-device interoperability, Matter stands to reduce installation time and the costs associated with creating and upgrading smart homes.

In fact, the top three ways in which dealers who are familiar with Matter expect the standard to impact their business all relate to ease of install: easier system installation, easier integration with products the customer already owns and easier addition of smart devices after the initial install.

Greater interoperability between products benefits all adopters, but it can also attract new entrants that will compete with established security vendors. It lowers the barrier to entry for offering a smart security solution, thus encouraging even more competition from DIY players.

Even in an age of ubiquitous Matter, though, there still will be value for service providers in offering a portfolio of devices and applications that establish advanced features, such as groups and routines.

Security providers are also valuable conduits for maintenance and service requests, account management and upsell/cross-sell of other home services.

The Disruptive Potential of Artificial Intelligence

Like Matter, artificial intelligence (AI) stands to disrupt the security and smart-home market. AI is already at the core of technologies like facial recognition and video verification to reduce false alarms.

Generative AI, most commonly associated with public-facing Large Language Models (LLMs) like ChatGPT or Google’s Bard AI, is forging a new expectation of how consumers interact with, and what they can expect from, smart-home devices and systems.

More intuitive assistants will smooth the friction that users encounter when, for instance, having to specify which smart-home device an app or assistant should control in a complex installation. It also stands to raise the perceived benefits of creating a smart home.

At its September 2023 device launch, Amazon showed off a generative-AI-infused version of Alexa that moves the assistant several rungs up on the evolutionary ladder, greatly improving its knowledge base and conversational style.

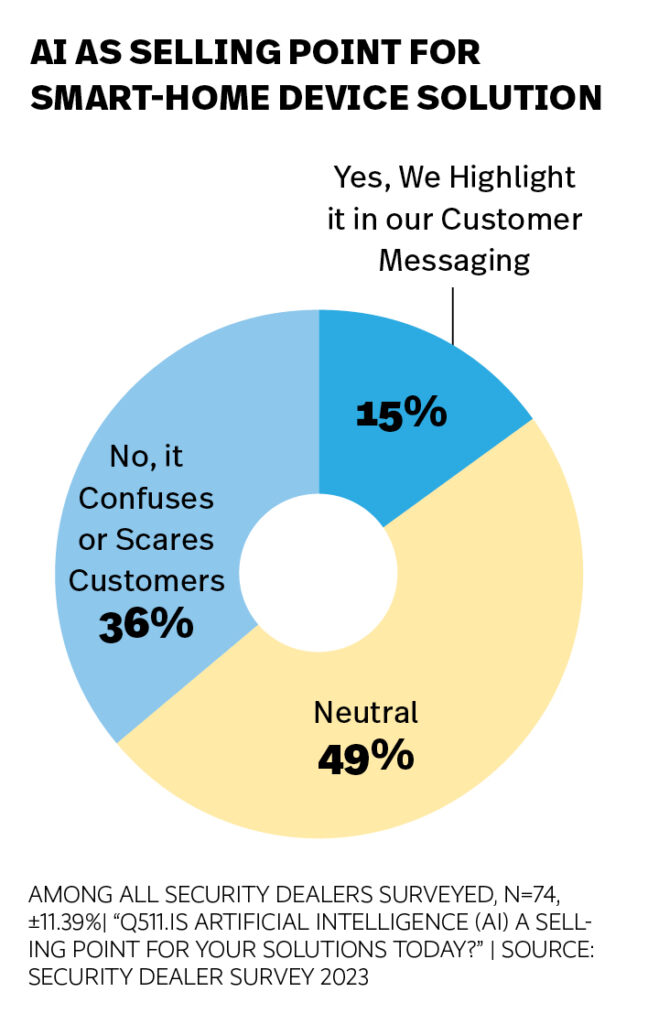

Most dealers are not yet marketing AI as a highlight of their solutions. Just 15% report highlighting AI in their customer messaging, whereas more than twice that percentage are concerned that AI confuses or scares their customers.

However, behind the scenes, 78% of dealers say AI is impacting their business. Nearly one-third report that AI reduces false alarms, while 28% rely on AI-powered insights to better understand how their customers are using their systems and devices.

This type of insight assumes a modern, connected, interactive system in which usage data flows easily and users trust their security provider to access and protect that data responsibly.

Summary

Security dealers face a challenging landscape that presents a depressed housing market; high inflation, limiting consumer spending; and nimble competitors. Dealers embrace smart-home devices to differentiate their system tiers and drive both hardware sales and recurring service revenues.

The average security dealer is not yet prepared to embrace two potentially disruptive forces in the security market: the Matter standard and AI. Matter promises to make technical installations far easier; accordingly, dealers would benefit from educating their staff on new onboarding methods for Matter-enabled devices.

With AI, the smart security market is about to become even more intelligent, which could be a boon for security dealers whose firms can capitalize on home automation. Finally, it might be possible to create an experience that feels like an intuitive, helpful and coordinated smart and secure home.

Jennifer Kent is the VP of research for Parks Associates.

Click here to dive even deeper into the 2023 Security Dealer Perspectives: Views from the Front Line!

If you enjoyed this article and want to receive more valuable industry content like this, click here to sign up for our FREE digital newsletters!

Security Is Our Business, Too

For professionals who recommend, buy and install all types of electronic security equipment, a free subscription to Commercial Integrator + Security Sales & Integration is like having a consultant on call. You’ll find an ideal balance of technology and business coverage, with installation tips and techniques for products and updates on how to add to your bottom line.

A FREE subscription to the top resource for security and integration industry will prove to be invaluable.